how to lower property taxes in nj

Here are five interventions to cut spending and reduce property taxes. Click on your county.

N J S Average Property Tax Bill Tops 9k Again Here S How Much It Went Up Last Year Nj Com

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

. And this week it came to light that Kevin Corbett the head of NJ Transit was also a beneficiary of the program cutting his tax bill on five of the six acres of his Mendham. On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. New Jersey doesnt have to continue to be the butt of jokes and derision by the leaders of more fiscally disciplined states.

New Jerseys high property taxes are notorious and in 2020 they hit a new high. If New Jersey switched all local employees to such a gold plan governments could cut property taxes by nearly 9 percentthats 25 billion in spending at the county and. Review your tax bill Typically you can only appeal an assessmentnot your billbut if you find any errors in your tax bill contact your assessor.

Hunterdon County collects the highest property tax in New Jersey levying an average of. The measure would change the deduction for rent payments considered as property taxes from 18 to 30. How Can I Lower My Property Taxes in NJ.

All real property is assessed according to the same standard of value except for qualified. 830 am - 430 pm Monday - Friday. Many New Jersey homeowners are entitled to a rebate or credit thats a percentage of the first 10000 in property tax that they paid last year.

New Jerseys real property tax is an ad valorem tax or a tax according to value. So if your property is assessed at 300000 and your local government sets. But in these 30 towns taxpayers pay anywhere from half to 6 of that average tax bill.

The exact property tax levied depends on the county in New Jersey the property is located in. As one example property taxes could be reduced by. New Jersey voters tried unsuccessfully in 1981 in.

Give power back to the people of New Jersey. Rasmussen said the average New Jersey renter who pays. If you maintain all other eligibility requirements you will have to file Form PTR-1 next year to re-establish yourself in the program using the lower property tax amount as your new base year.

It allowed us to create a login and enter the evidence including. The percentage depends on the owners annual. Go to the New Jersey Division of Taxation website through the link in the References section.

Find the three tax ratios for your city.

Nj Property Tax Relief Program Updates Access Wealth

Florida Property Tax H R Block

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

10 Us Cities With Highest Property Taxes Infographic Property Tax Data Visualization

Guide To Pa Property Taxes Psecu

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Deducting Property Taxes H R Block

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Things That Make Your Property Taxes Go Up

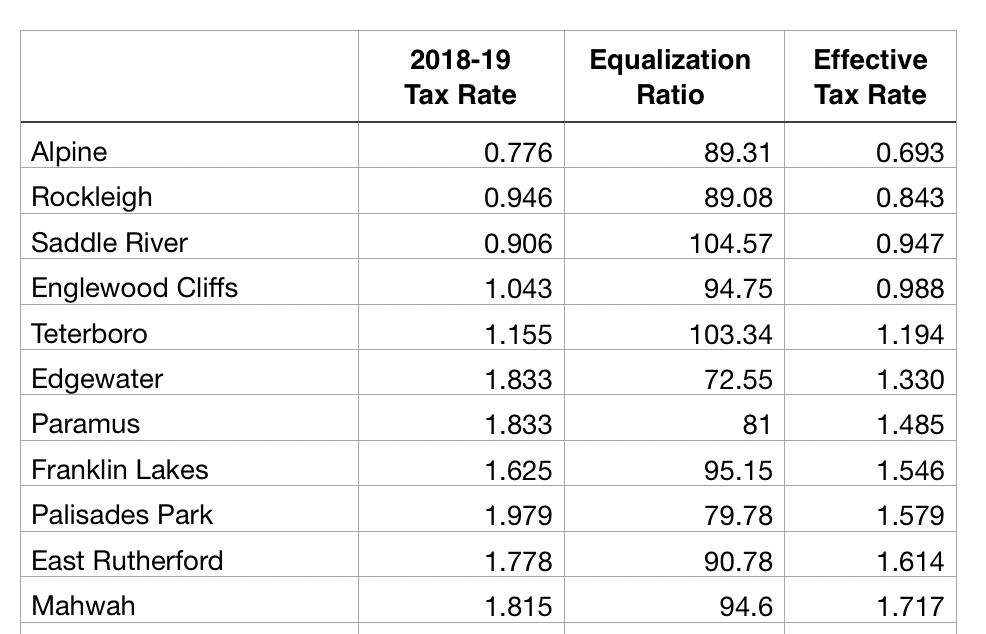

Bergen County Tax Rates For 2018 2019 Michael Shetler

Nutley Real Estate Homes For Sale Information About Nutley Nj Real Estate Real Estate Tips Real Estate Nj

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Debt Relief Programs

Property Taxes In Nevada Guinn Center For Policy Priorities

How To Cut Your Property Taxes Credit Com

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Pin On Real Estate Investing Tips

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com